Value at Risk (VaR) Analysis of AAPL Stock

Overview

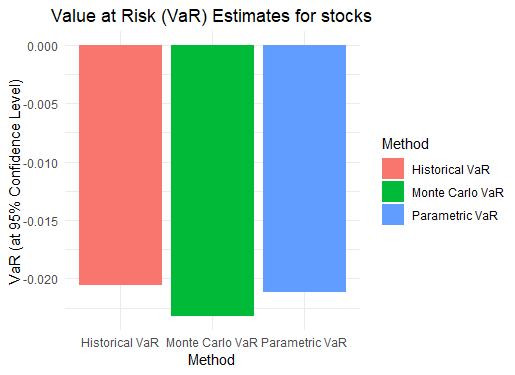

This project performs a comprehensive Value at Risk (VaR) analysis of Apple Inc. (AAPL) stock, utilizing multiple risk estimation techniques. VaR is a key risk management metric used to estimate the potential loss in value of an asset over a given time period with a specified confidence level. The analysis employs historical VaR, parametric (Gaussian) VaR, and Monte Carlo simulation to assess potential downside risk.

Methodology

1. Data Collection

- Retrieves historical stock prices of AAPL from Yahoo Finance using the

quantmodpackage. - Extracts the adjusted closing prices and calculates daily log returns.

- Handles missing values and ensures clean financial data.

2. VaR Calculation

- Historical VaR: Uses the empirical distribution of past returns to estimate risk.

- Parametric VaR: Assumes returns follow a normal distribution and calculates risk based on mean and standard deviation.

- Monte Carlo Simulation: Generates 10,000 return simulations based on historical statistics to estimate potential future losses.

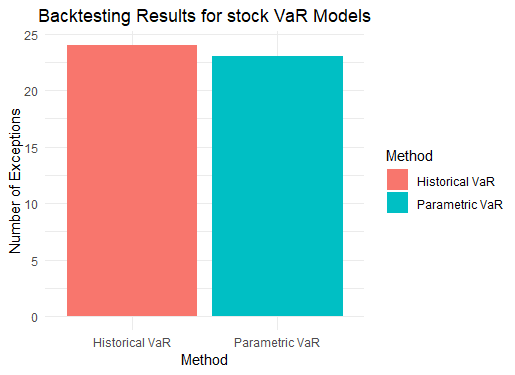

3. Backtesting

- Compares actual returns against calculated VaR thresholds.

- Counts exceptions where actual losses exceed the estimated VaR, evaluating model accuracy.

4. Visualization

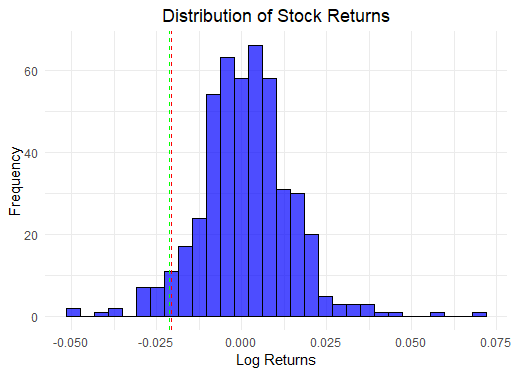

- Histogram of Returns: Displays the distribution of AAPL’s daily returns.

- VaR Thresholds: Red and green vertical lines indicate the historical and parametric VaR levels, respectively.

Technologies Used

- R Programming Language

quantmod– Financial data extractionPerformanceAnalytics– Risk and return analyticsggplot2– Data visualizationdplyr– Data manipulation

Key Insights

- The analysis provides an estimation of potential losses for AAPL stock under different market conditions.

- Backtesting ensures that the VaR models remain reliable for risk assessment.

- Combining multiple VaR methodologies allows for a more robust risk analysis.

Future Improvements

- Incorporate conditional VaR (CVaR) for deeper risk assessment.

- Extend analysis to multiple assets for portfolio-wide risk management.

- Utilize GARCH models to account for volatility clustering in financial time series.

This project demonstrates a quantitative approach to risk management, providing insights into financial market risk using statistical modeling and simulation techniques.

Images:

Code:

library(quantmod) # For financial data

library(PerformanceAnalytics) # For VaR calculation

library(ggplot2) # For visualization

library(dplyr) # For data manipulation

library(scales)

# Step 1: Data Collection

getSymbols("AAPL", src = "yahoo", from = "2023-01-01", to = Sys.Date())

stock_data <- get("AAPL")

# Calculate daily returns

returns <- dailyReturn(Cl(stock_data), type = "log") # Log returns

returns <- na.omit(returns)

# Step 2: VaR Calculation

# Historical VaR

historical_VaR <- VaR(returns, p = 0.95, method = "historical")

historical_VaR_value <- as.numeric(historical_VaR)

# Parametric VaR

parametric_VaR <- VaR(returns, p = 0.95, method = "gaussian")

parametric_VaR_value <- as.numeric(parametric_VaR)

# Monte Carlo Simulation (simulating 10,000 returns)

set.seed(123)

simulated_returns <- replicate(10000, {

mean_return <- mean(returns)

sd_return <- sd(returns)

rnorm(length(returns), mean = mean_return, sd = sd_return)

})

monte_carlo_VaR <- apply(simulated_returns, 2, function(x) quantile(x, 0.05))

# Step 3: Backtesting VaR

# Count exceptions for backtesting

exceptions_historical <- sum(returns < historical_VaR_value)

exceptions_parametric <- sum(returns < parametric_VaR_value)

# Step 4: Visualization

# 4.1 Distribution of Returns

ggplot(returns, aes(x = daily.returns)) +

geom_histogram(bins = 30, fill = "blue", color = "black", alpha = 0.7) +

geom_vline(xintercept = historical_VaR_value, color = "red", linetype = "dashed") +

geom_vline(xintercept = parametric_VaR_value, color = "green", linetype = "dashed") +

labs(title = "Distribution of Stock Returns",

x = "Log Returns",

y = "Frequency") +

theme_minimal() +

theme(plot.title = element_text(hjust = 0.5))

# 4.2 VaR Estimates

vaR_data <- data.frame(

Method = c("Historical VaR", "Parametric VaR", "Monte Carlo VaR"),

VaR = c(historical_VaR, parametric_VaR, quantile(monte_carlo_VaR, 0.05))

)

ggplot(vaR_data, aes(x = Method, y = VaR, fill = Method)) +

geom_bar(stat = "identity") +

labs(title = "Value at Risk (VaR) Estimates for stocks",

y = "VaR (at 95% Confidence Level)") +

theme_minimal() +

theme(plot.title = element_text(hjust = 0.5))

# 4.3 Backtesting Results

# Backtesting done on 100 trading days backtesting should not exceed 5

backtest_data <- data.frame(

Method = c("Historical VaR", "Parametric VaR"),

Exceptions = c(exceptions_historical, exceptions_parametric)

)

ggplot(backtest_data, aes(x = Method, y = Exceptions, fill = Method)) +

geom_bar(stat = "identity") +

labs(title = "Backtesting Results for stock VaR Models",

y = "Number of Exceptions") +

theme_minimal() +

theme(plot.title = element_text(hjust = 0.5))

# Print results

print("Historical VaR at 95% confidence level:", percent(historical_VaR_value, accuracy = 0.001), "\n")

print("Parametric VaR at 95% confidence level:", percent(parametric_VaR_value, accuracy = 0.001), "\n")

print("Monte Carlo VaR at 95% confidence level:", percent(quantile(monte_carlo_VaR, 0.05), accuracy = 0.001), "\n")

print("Number of exceptions (Historical VaR):", exceptions_historical, "\n")

print("Number of exceptions (Parametric VaR):", exceptions_parametric, "\n")